:max_bytes(150000):strip_icc()/latex_6c7a0d7f7c0d89ab52e365b95a7a3ee3-5c64b988c9e77c0001566f29.jpg)

To calculate how fast a company can earn a profit To determine if companies are using their resources well or if funds need to be reallocated To identify effective company management practices and effective managers

To compare investments before making the best choice for the company To find the profitability of an investment before calculating debt To determine if a transaction is worth the financial investment

:max_bytes(150000):strip_icc()/ReturnonAssetsRatio-17f7a24b651140b1b2101b72b72b4789.png)

Investors calculate RO! to help determine where they should invest their financial assets.īusinesses consider their ROI to help determine the following ideas: Businesses use ROI to understand how investments can generate the most profit. Return on investment (ROI) is a measure used to determine the benefits and worth of an investment or allocation of assets. In this article, we explain how return on investment and return on assets both offer different ways to analyze the profitability of company assets and investments including the formulas used to calculate each type of figure. By understanding these financial perspectives, you can gain a better understanding of how a business is performing and use this information to advise stakeholders or decision-makers within a company. Both return on investment and return on assets are terms that describe the type of calculation used to give financial professionals and business leaders a clear picture of how a company generates profits.

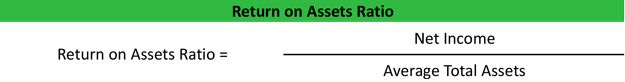

We can help to keep cash flowing through your business helping with ad hoc payments or recurring payments.When businesses need to determine the outcome of investing their financial resources, they can look at two different types of figures to understand their financial success. The more efficiently a business is run, the higher the return on assets percentage will be, and the latest payments technology from GoCardless can play a part in making that happen. In comparison, the same figures for two other major oil companies in 2017 were as follows: This means that for every dollar of assets held by Exxon in 2017 the company generated 5.8 cents in profit. Calculating the return on assets for Exxon over this period therefore means dividing $19.7 billion by $339.5 billion, which gives a figure of 5.8%. In 2017, the net income of Exxon – meaning the profits after expenses – was $19.7 billion. In 2017 the total assets of Exxon were valued at $349 billionīy adding these two figures together and dividing by two we arrive at the average assets over the period 2016/2017 of $339.5 billion. In 2016 the total assets of Exxon were valued at $330 billion Perhaps the easiest way of explaining how return on assets calculations work is to give a real world example, in this case using the Exxon Mobil Corporation: Return on Assets = Net Profit / Average Assets An example of a return on assets calculation The calculation can be set out as follows: The return on assets figure is calculated by taking the net income of a business and dividing that figure by the total assets of the company. While comparing profits to revenue gives an idea of how successfully a business is operating, making a comparison between those profits and the resources that had to be exploited to generate the profits gives a much fuller picture, and the good news is that the return on assets formula is, in basic terms, actually fairly simple. Calculating the return on assets of a number of different companies of comparable size working in the same sector makes it possible to see which of those businesses is the most well run. Once it has been calculated, the return on assets is expressed as a percentage, and the higher the percentage is the better it is for the business in question. At face value this may seem like a fairly simple question to answer the income a business generates minus the expenses it incurs will leave you with a figure which represents the profit generated by a business.Ĭalculating the return on assets, however, delivers a far more accurate picture of how efficiently a business is making use of the assets it owns. One of the most important questions you can ask yourself when looking at a business – particularly if you’re thinking of working with or investing in that business – is how profitable it is.

0 kommentar(er)

0 kommentar(er)